Empty dropdown

Notes:Data is as of 30 September 2024. Location is based on where company is incorporated.

24 min read

Talent is the driving force behind any startup, and the landscape has been transformed over the past decade. In this chapter, we dig into who the individuals forming the beating heart of Europe’s tech ecosystem are — from founders to employees — to unpack what's changed, and how they feel about the future.

Share

Europe has gone from strength to strength in nurturing and growing its tech talent pool. Over the past decade, entrepreneurship has become a preferred path for ambitious and exceptional talent at every stage of their career. From recent graduates to seasoned professionals, the region now benefits from a vibrant community of experienced founders, engineers and operators driving innovation across the continent.

Zooming in on founders, it is clear that European entrepreneurs have increasingly embraced risk and a bolder approach. This shift in mindset is reflected in the ambition level of new ventures, the global outlook from day one, and a willingness to tackle some of the toughest problems in a more sustainable way.

While European founders are increasingly in control of their narrative and optimistic about the future, their overall confidence in Europe's competitiveness is trending down. They are championing the strengths and unique qualities of the European tech scene, while challenging the remaining barriers that prevent Europe from realising its full potential. Over the next decade, this proactive stance will reshape global perceptions and enable Europe to retain its best talent — the critical ingredient for even greater progress.

If you have a great idea, you don't have to go to the United States. You have great investors and talent here. You have a vibrant community of people coming together, working together and tapping into that richness of ideas. It's a real path now to be a European entrepreneur. That's the real change."

Baroness Joanna Shields

CEO & co-founder, Precognition

Europe’s talent landscape has transformed over the past decade, and the startup ecosystem now attracts more employees than ever. Today, the European tech workforce stands at 3.5M. The vast majority — 2.9M — of those employees have joined over the past decade, and they have done so at a rate that puts Europe on par with the US’s more established scene.

These figures are even more impressive in the context of the last two years, when headlines about funding shortages and staff redundancies have been hard to miss. Against the odds, Europe's tech sector has remained attractive to new talent and its importance as a contributor to the continent's workforce continues to grow.

Europe's tech workforce has seen dramatic growth across the board. In VC-backed companies, there has been an almost fourfold increase in the overall volume of talent and significant increases across all stages. Today, the distribution of employees across VC-backed companies at different funding stages in Europe is comparable to that seen in the US ecosystem in 2015.

While the VC-backed employee base has grown at a similar pace to wider tech employment, the difference by stage is striking. The volume at Pre-Seed companies experienced a threefold surge from 36,000 in 2015 to 111,000 in 2024; and Seed stage companies have seen a similar rise, from 78,000 to over 250,000.

Most notable, however, is the almost fivefold increase in the number of tech employees at Series C and beyond, from 36,000 to almost 175,000. This shift illustrates a growing trend towards experienced talent in later-stage companies, where the majority of tech talent now resides. This is critical as more employees are exposed to different stages of a company's scaling journey.

Building a business is an ongoing journey full of challenges. With the right support in place, founders have a better chance of navigating it successfully.

Europe has made significant progress in this regard, with 58% of founders saying they have better access to mentors, accelerators, knowledge and information now than when they started their business. Founders also report a positive shift in the public perception of startups and entrepreneurship, especially for those who have been in the tech industry for 10 years or more.

Responses are mixed on whether other key growth levers have improved, such as access to capital and ease of starting a business, although it’s encouraging to see that more long-term founders are signalling positive changes in these areas. Still, it’s clear the regulatory environment has made very slow progress, as the gap between this topic and all others suggests.

Founders with more than 10 years' experience have seen progress in diversity and inclusion over the past decade. Respondents from under-represented groups — be it those who self-identify as non-white and/or with a disability — agree, although in smaller numbers. They also report less progress when it comes to public perceptions of entrepreneurship, and those with a disability are less likely to have seen significant progress in terms of access to capital.

The excellent education system, numerous effective support programs, thriving early stage funding scene and world class operators and technologists turned entrepreneurs are all compounding to make various European cities leading global technology hubs in the age of AI. I couldn’t be more excited for where we will be in a decade!"

Mehdi Ghissassi

CPO, AI 71

34%

We are seeing a turnaround in hiring activity. Job postings for VC-backed companies were up 25% in the first half of 2024 compared to the previous six months, finally reversing the declines we've seen over the past two years.

A number of drivers are behind this growth. By stage, the biggest contributors are Seed, Series A and B startups, suggesting renewed confidence at these crucial stages of growth. By function, it's customer service roles that are most in need, suggesting that companies are responding to improved commercial demand.

This year the number of founders who told us the talent market has eased over the past 12 months has grown — to 33%, up from 29% in 2023. This is in stark contrast to the heady days of 2021, when record amounts of capital were flowing into European startups and only 15% of founders told us they were finding it easier to recruit talent.

The share of founders describing the recruitment market as difficult has also fallen accordingly. While almost half of founders said it was difficult to hire talent in 2021, only 34% say the same today. Given the layoffs in 2023, it's possible that companies looking to hire had a larger pool of available talent.

Still, hiring is never easy, regardless of what else is going on in the broader market. Respondents are evenly split on whether things have become easier, harder or stayed the same. In terms of the latter, the number of respondents who say the talent market is 'unchanged' has remained stable over the past four years at around 35%.

Europe’s tech talent scene has grown leaps and bounds in the last decade, but some problems remain unsolved. When it comes to pay equality, notable wage gaps between men and women are still being reported in engineering and finance roles at European startups.

This problem is better understood by unpacking unadjusted and adjusted pay gap data. The former refers to the raw difference in median earnings between men and women, while the latter also takes into account broader factors affecting salary such as job level, job function, or the country they perform their work in. Adjusting the raw data to account for these helps us paint a like-for-like comparison and answer the question of whether men and women are receiving equal pay for equal work.

When zooming in on the finance and engineering functions, the high unadjusted pay gaps are driven by a lack of women in senior positions, whilst the high adjusted pay gaps point to a genuine pay equity issue, where men are paid more than women even after adjusting for factors like role, seniority, and location. We see a lack of female representation in the engineering function in particular, with women making up just 5% of executives.

By contrast, the people and marketing functions stand out as having high female representation and low adjusted and unadjusted pay gaps.

The bench of engineering talent available to companies building in Europe has deepened significantly.

Hiring patterns have fluctuated in response to market conditions, with a likely pandemic-related dip in 2020, followed by a rebound in the peak years of 2021 and 2022. By 2023, the rising cost of capital had encouraged firms to be more cautious about spending, including on hiring tech talent. This year, hiring for engineering roles has picked up again.

This vital talent pool — the backbone of most tech companies — has shifted over time towards more experienced sources who already have experience in the tech industry. In 2015, 25% of all new hires came from other tech companies, compared to 38% today. This also represents a 170% increase since 2015 in terms of absolute talent movement.

While they account for a small share of the overall talent movement, large tech companies such as Microsoft or Amazon now contribute twice as many hires as they did in 2015. Non-tech firms remain one of the largest contributors of engineering talent, with 50% of new hires in 2024 coming from these firms.

The number of first-time jobseekers has fallen as a contributor to the total, as more established talent experiences the market pull of tech. Worryingly, the overall pipeline of new graduates has continued to fall this year, despite new hires across all other experience levels increasing year on year. Graduate hiring is a positive leading indicator of future talent availability, and the impact of the reduction in tech graduate programmes is likely to be felt a few years down the line.

In absolute terms, the UK, France and Germany have maintained their positions as the top tech nations over the past decade. However, compared to 2015, the race to the top has become hotter, with several nations moving ahead in terms of employees per million inhabitants.

Finland has maintained its position at the top since 2015. It crossed the 10,000 tech employees per million inhabitants threshold a decade ago — a feat that only four European nations have now caught up with — largely due to the fact that Nokia, Europe's largest tech employer, is based in the country.

Even more remarkable is the growth of runner-up Estonia. The country has seen its tech workforce increase almost tenfold in the past decade, from more than 1,000 to almost 11,000 per million people. Estonia has played a major role in the creation of some of Europe's most famous $1B+ companies, such as Bolt, Wise and, of course, Skype.

Despite significant differences, both nations have made innovation an imperative. Technology is a key factor in their ability to drive economic growth, despite their smaller populations. Their governments play a crucial role in funding this innovation, not only through support for R&D and favourable tax regimes, but also through the adoption of technology across public services.

Daniel Ek, Founder, Spotify

The past few years have been tricky for founders, marked by fundraising challenges and tough decisions around staffing. Understandably, this has led many founders to question whether current market conditions are conducive to embarking on the entrepreneurial journey.

This year, 39% of respondents said now is a less attractive time to become a founder compared to 12 months ago, which is a slight regression on last year’s 36%. Only a minority of founders think we’re out of the woods, with just 25% saying things are better than last year.

But looking at the bigger picture, the outlook is much more positive. When asked what things are like today compared to 10 years ago, the vast majority — 59% — say it’s a better time to be a founder, despite recent setbacks.

While most new tech jobs are filled by local hires, the inflow of tech talent into Europe from around the world is a strong indicator of the continent’s standing in the global tech industry. For reference, out of the 3.5M people working in tech as of 2024, close to 80% have originated from Europe. The remaining 20% have come from the US, China, India or even Brazil, which have been some of the top contributors over the years.

Since 2016, the continent has been a net beneficiary of talent, attracting more people on balance than it has lost. But since 2022, Europe has lost more talent to the US, Australia, and Canada than it has gained from those countries. If European tech can't become more competitive, it risks missing out on the valuable perspectives and networks that these professionals bring.

From AI pioneers in Paris to deep tech innovators in Berlin, we're seeing founders tackle humanity's biggest challenges. With over 35,000 early-stage startups active across the continent, Europe isn't just growing talent, it's transforming it into world-changing companies."

Andreas Chatzakis

Director, Startups, AWS (EMEA)

The net flow of talent from the US to Europe has gone from negative to positive — and back again. The overall trend has been positive, as the outflow of talent has been declining for most of the period, but competition for the most experienced and scarce talent remains fierce.

When the data is broken down by experience level, the net flow of junior talent from the US to Europe has steadily increased over time. Mid-level and senior talent, however, has started to decline over the past 24 months.

In terms of function, technical employees, labelled as 'tech', are moving to the US in greater numbers. We find the usual suspects among the top talent movers — big tech companies such as Google, Microsoft, Amazon or IBM dictate the tech talent flows.

This loss of talent could be linked to the tech layoffs seen around the world in 2022, where visas may have been lost along with jobs, or perhaps return-to-office policies initiated by a number of large tech companies have required remote workers to return to their employer’s country. Since then, the numbers have trended closer to balance, but remain subdued.

To stem the flow of senior (and wider tech) talent out of Europe, startups and scaleups need to consider how their offers and prospects — including salaries, equity compensation and benefits — compare to what's available abroad. But it doesn't stop there. There is also a need to increase Europe's competitiveness to ensure the best and brightest talent choose to build in Europe rather than elsewhere.

Europe's AI talent landscape is almost unrecognisable today compared to a decade ago. Back in 2015, there were small pockets of AI talent scattered across the continent. Since then, there has been a widespread increase in AI roles across Europe, with clear centres of excellence emerging across the continent. This trend is indicative of the strategic importance of AI to future economic growth, with the increase in roles reflecting the growing demand for expertise.

The UK leads the way with nearly 60,000 active AI roles — an impressive fivefold increase on the 12,000 positions in 2015. The Netherlands and Germany follow with similar leaps of 3x and 5x respectively. Relative to population size, countries like Ireland benefit from hosting the European headquarters of large US tech companies.

Over the past 10 years, the rise of AI adoption has led to more than a sixfold increase in AI roles in Europe. Last year, Europe was ahead when we took a snapshot of the number of active AI roles in the region, while this year the trend has reversed in favour of the US.

There is a tight race for AI talent, and the US is in a sprint. It appears companies based in the US are hiring for these roles faster than in Europe. While Europe is home to world-renowned academic hubs — including Oxford University, the Max Planck Institute for Informatics and ETH Zurich — that have long fostered these skills, companies in the region might be missing a trick if they are not taking full advantage of this talent.

Europe is neck-and-neck with the US in terms of the growth of its overall AI talent pool. In Europe, private venture-backed companies hire around 13% of the total AI talent pool, compared to 16% in the US. The majority of talent in the US is concentrated in either large, publicly traded tech companies or other private, non-VC-backed companies.

When we segment this data to look only at venture-backed companies, Europe is more skewed towards early-stage startups. When broken down by funding stage, the majority (39%) work in pre-Series A companies, compared to 23% in the US. This is in line with trends seen in the broader tech talent base, with 41% working in pre-Series A companies.

This data reiterates the critical importance of local, growth-stage capital in Europe to support teams as they develop into leading AI companies. This will be crucial for the region to scale the impact of its rich AI startup ecosystem.

There's so much opportunity for talented engineers now that if the startup fails, they're not going to be left high and dry. There's such an ecosystem to to support. The willingness of people to jump into to tech start-ups to to get building, to iterate, to grow or fail fast, has really blossomed and allowed us to build the team that got our first prototype to get a very quickly."

Alex Kendall

Co-founder, Wayve

In the US, the percentage of companies being founded by European expats has risen.

While the figure had remained relatively stable since 2015, hovering between 7% and 9%, it climbed notably following the pandemic. In 2021, the share of new US companies with at least one founder who previously worked in Europe rose to 11%, before hitting a peak of 12% in 2022. Although the number has levelled at 11% again , they remain higher than a decade ago. In other words, European founders are powering at least 10% of US innovation.

Conversely, the share of European companies being set up by US founders has always been lower, but still represents a meaningful number at around 6% across the period. While 2017 saw the percentage peak at 7%, coming nearly to par with the European founders starting companies in the US, the delta has since widened.

While more European founders are heading to the US to set up companies than vice versa, the numbers suggest it is far from a mass exodus. Having said that, it still represents a meaningful number of companies — on average each year, this talent leakage leads to at least 800 companies starting in the US instead of Europe.

Tech entrepreneurship in Europe is as attractive a career path today as it was a decade ago, despite the economic ups and downs seen over that period.

So far in 2024, we have already identified 16,000 unique founders who have started companies, which is on par with 2015 levels. We can expect this number to continue to grow as more founders update their experience over time. For example, since last year we have identified nearly 2,000 additional founders who started their businesses in 2023.

Europe has also consistently seen more founders starting companies than the US.

For many, this is not their first rodeo. Serial founders with two or more businesses under their belt now make up 9% of the founder pool, up from 6% in 2015. These repeat founders bring invaluable experience to their next ventures, while also mentoring new generations of talent.

If they had to do it over again, would Europe's founders still choose to set their businesses up here? The answer is yes. In a huge vote of confidence in the continent's startup ecosystem, more than 50% of founders told us they would start their company in the same country they are in now, while 17% said they would change countries but stay in Europe.

This is in line with the results of our first survey in 2015, and shows just how much Europe's founders believe in the local ecosystem.

In Europe, the share of founders with five or more years’ experience in the tech sector has doubled over the past decade.

In 2015, just 10% of founders fit this description. Today, the figure is 20%, while the share of entrepreneurs whose first ever job was founding a company has more than halved to 8%.

This shows us how robust Europe’s tech sector has become over the past decade. Aspiring founders now have more opportunities to train up in the sector and learn from the best before setting up. In fact, since 2015 there has been a near threefold increase in the share of founders with more than 10 years of prior experience in the tech industry.

Tech professionals with senior leadership experience at billion-dollar companies are becoming an ever-more common feature of Europe’s talent market.

Today, over 12,000 tech professionals in Europe list a senior leadership role at a $1B+ business on their CV — roughly four times as many as in 2015.

Most are honing their skills at local companies, with established European firms such as Booking.com providing a training ground for new generations of leaders. But there is also a deep pool of experienced senior talent being trained by international companies, who are then recycling the knowledge and networks gained within the European tech ecosystem. Almost a third of these executives have worked for US $1B+ companies, with Airbnb, YouTube and Facebook being the most common former employers. A further 16% have worked for companies headquartered elsewhere in the world, with Canada's Shopify and China's ByteDance contributing significant amounts of senior talent to the European ecosystem.

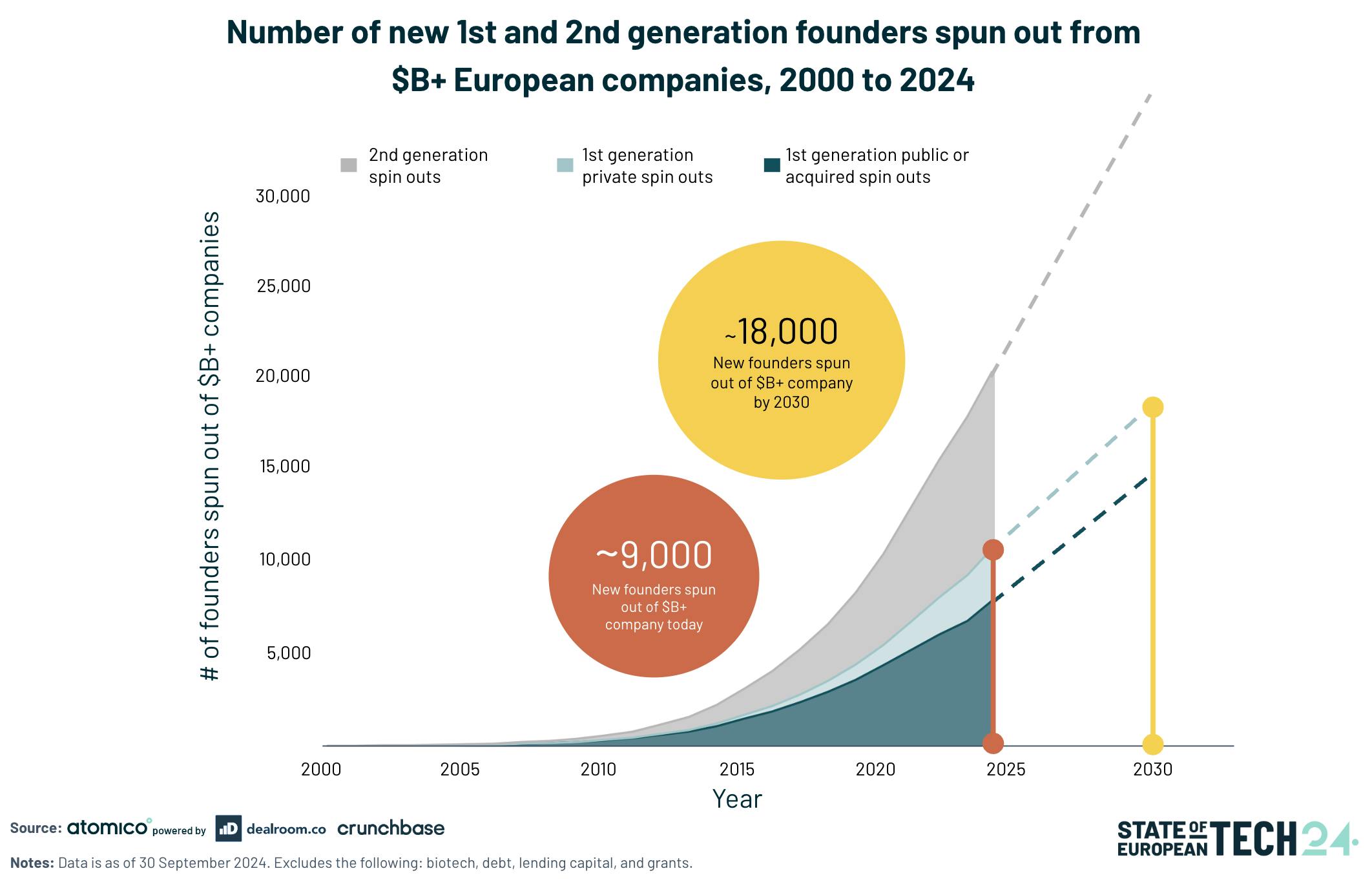

The compounding effect of Europe's tech flywheel becomes clear when we look at how many new companies are spun off from billion-dollar success stories.

This graph shows the exponential rate at which this is happening. Since 2000, more than 9,000 new companies have been spun out of $1B+ European companies. By 2030, we could expect this number to have multiplied to around 18,000.

High-valued companies that achieve exits are the primary drivers of this flywheel. Exits unlock both capital and talent, fueling further growth and putting the flywheel firmly in motion, whereby outsized outcomes ripple their benefits through the wider ecosystem. The founders that emerge from these companies have a head start thanks to the knowledge and networks they have absorbed by working with best-in-class teams and founders.

But that’s not all — the companies they found go on to generate their own spinouts, too. There are an additional 8,500 founders in Europe who can trace their origins back to a ‘grandparent’ company worth $1B+.

The recycling of talent continually raises the bar for the entire ecosystem, as one generation of successful founders nurtures the next. The past decade has been instrumental in instilling the belief that great companies can come from anywhere; it has also demonstrated the multiplier effect of an extensive alumni network.

Skype is a prime example, with more than 900 companies founded by its alumni around the world. Members of the so-called 'Skype Mafia' have even formed their own clusters of next-generation founders. The AI savings app Plum, for example, was founded by a former Wise employee — and Wise itself was co-founded by a Skype alum.

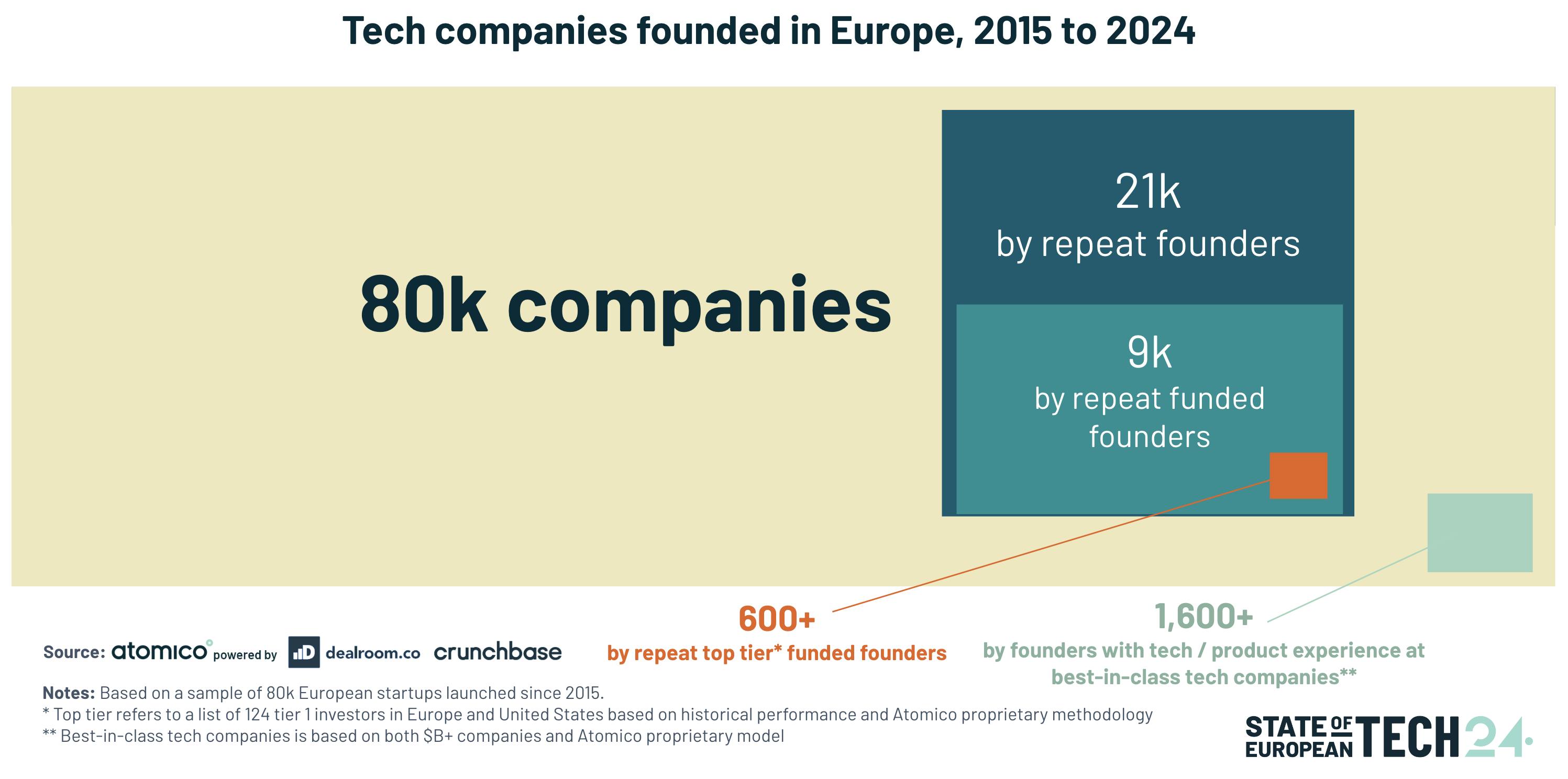

Among the impressive quantity of tech companies founded in Europe since 2015 — more than 80,000 — a quarter have been started by repeat founders. Of these, around 600 were started by repeat founders who also received funding from top-tier investors.

There are also more than 1,600 companies started by founders with previous experience in engineering or product roles at some of the world's best technology companies.

These are all aspects of the continuous recycling of talent that drives the ecosystem forward, and the data tells us that founders with these backgrounds are also more likely to have success with their next companies.

Founders with experience at top technology companies represent only a small proportion of the total founder pool. Those who are repeat entrepreneurs or who have previously secured backing from Europe's top VCs make up an even smaller number.

Yet when it comes to which of Europe's new companies are most likely to reach a billion-dollar valuation, these founders are vastly overrepresented.

It's logical that attributes such as having founded a company before or being backed by a top-tier investor would lead to a higher likelihood of success. Indeed, repeat founders are 1.6 times more likely to achieve a billion-dollar valuation with their next company, and those previously backed by top VCs are almost five times more likely.

First-time founders can also outperform. Those with previous experience in a technical or product role at a world-class technology company are 3.2 times more likely to build a billion-dollar company themselves.

These findings underscore the value of networks, knowledge and expertise acquired along the way that can be leveraged for better results.

The bottom line is that success breeds success — and that's why it's important to keep the talent flywheel in Europe going.

From “building a multi-billion dollar revenue business” to “life on Mars”, European founders continue to shoot for the stars. Notably, beyond the goals of revenue targets, market leadership and big exits, many founders cite making a positive impact as their ultimate goal.

For 41% of respondents, their ambition is not to build a business, but "leave a legacy with a significant environmental and financial contribution". Some respondents told us they will achieve success when their brand is "ubiquitous". What struck us as we read through the most ambitious statements from the thousands of responses was the clear alignment of success with positive outcomes for the planet — for example, one respondent mentioned "permanently removing 1 gigatonne of CO2 per year, profitably", while another is looking to "build a generational business that can reduce electricity costs by 95%".

The ability to impact society is also evident in some of the metrics communicated by founders, such as "1 billion happy users and 1,000 happy employees", or having "the largest market capitalisation in Europe".

Here, we look at how Europe's investor landscape has shaped up over the past decade. From angels and venture capital firms to large institutional investors, we dive into who is backing the venture asset class, how their perspectives changed over time and what their priorities are going forward.

Numerous initiatives and campaigns have taken aim at the lack of diversity in the European tech ecosystem. But despite these efforts, the needle hasn’t moved nearly enough over the past decade.

The Nordics region has firmly established itself as a European tech leader, home to era-defining companies like Spotify and Klarna. Companies in this region are especially strong in sectors like gaming, fintech and cleantech, and more global leaders are being produced here. This fast-track insight digs into the Nordic growth data.