Empty dropdown

Notes:Data is as of 30 September 2024.

21 min read

Where will Europe’s next breakout companies emerge? In this chapter, we take a thematic lens to the tech ecosystem, exploring the sectors producing global success stories, and drilling down into the themes capturing investor attention.

Share

Over the past decade, Europe has demonstrated its ability to produce category-leading global champions across a wide range of sectors, from finance and retail to healthcare and deep tech. Companies such as Spotify and Revolut have come to define the region's success in building global technology, but it does not stop there: in our survey, an impressive diversity of over 110 companies were recognised by respondents as emblematic of European innovation.

However, there are a number of challenges that stand in the way of visionary and bold founders realising their full potential in Europe. There is still a significant funding gap in strategic areas that underpin much of what our future will be built on. There is a global technology race and Europe can still win if it takes bold action to change course. To remain competitive, Europe must redouble its support for transformative areas such as Sustainability / Climate, AI and other Enabling Technologies.

Encouragingly, Europe's commitment to sustainability sets it apart: in 2024, 21% of total capital invested in European technology will be targeted at climate or sustainability initiatives, almost double the share in the US. Europe's talent and ambition signal a promising decade ahead, if bold steps are taken to realise the continent's full potential.

To better understand the flow of value, talent and capital in Europe, we have developed a proprietary framework that organises companies into sectors, themes and clusters. Here we are looking at sectors — there will be more on themes and clusters later in the chapter.

Sectors represent the broad industries that shape the global economy, such as Finance or Transportation, and are the highest level of our taxonomy. While a company may fit into multiple themes, it can only be categorised into one sector.

The variety of $B+ companies speaks to European technology's ability to build global, category-defining companies over time. Europe's historical strengths have been in Manufacturing and Enabling Technologies (e.g. electronics, semiconductors) as well as being a Consumer powerhouse (e.g. games, music, travel). The next wave of companies focused on Finance, Software and Sustainability / Climate.

These trends can be seen when looking at Europe's most highly valued companies by sector. Since 2015, Dutch chipmaker ASML has seen its value increase almost tenfold in 2024, from $40B to over $300B (although since the data cut-off date, its market cap has come down from its 2024 highs). Over the same period, Spotify's valuation has increased eightfold, from $8.5B to $70.7B.

It also speaks to what makes the continent unique — Europe has managed to create a multitude of vibrant ecosystems, rather than one central hub. The companies included here represent as many as 12 countries. From Ukrainian education company Grammarly to Austrian observability leader Dynatrace and Estonian mobility app Bolt, global leaders have emerged from across the continent.

HQ: Netherlands

Valuation: $326.4B

HQ: United Kingdom

Valuation: $147.7B

HQ: Netherlands

Valuation: $142.0B

HQ: Sweden

Valuation: $70.7B

HQ: United Kingdom

Valuation: $64.3B

HQ: United Kingdom

Valuation: $45.0B

HQ: United Kingdom

Valuation: $40.0B

HQ: Spain

Valuation: $34.6B

HQ: Netherlands

Valuation: $21.4B

HQ: Netherlands

Valuation: $17.5B

HQ: Germany

Valuation: $16.1B

HQ: Norway

Valuation: $15.8B

HQ: Austria

Valuation: $15.0B

HQ: Ukraine

Valuation: $13.0B

HQ: Switzerland

Valuation: $11.2B

HQ: Czech Republic

Valuation: $8.6B

HQ: Estonia

Valuation: $8.4B

HQ: France

Valuation: $6.5B

HQ: Germany

Valuation: $2.8B

HQ: Germany

Valuation: $2.3B

In recent years, European companies valued at more than $1B have emerged at an increasing pace. The number of new $B+ companies added over the last decade is five times the level seen before 2015.

Back then, the Social & Lifestyle sector accounted for the largest share (22%) of Europe's $B+ companies, with Enabling Technologies following at 19%, and Retail in third place at 17%. However, over the last decade, Finance has become the leading sector with globally recognised names such as Stripe, Klarna and Revolut demonstrating Europe's strength in the sector. It accounts for 24% of new $B+ companies added in the last five years, followed by Horizontal Software at 19%.

The Sustainability / Climate sector, which includes themes such as energy or carbon removal, has seen modest growth, accounting for 5% of $B+ companies created between 2020 and 2024. This limited representation contrasts with the significant investor focus on the sector. The solutions here are often more capital intensive, and access to follow-on funding remains a key risk in these companies' journey to scale. However, these large-scale projects are critical to make a meaningful contribution to the climate crisis.

Europe has also seen its first $B+ companies emerge in the Education and Health sectors over the past decade. Both sectors have continued to grow their share in the last five years, and it will be exciting to see who follows in the footsteps of companies like Multiverse and Doctolib.

Over the past decade, Europe’s funding priorities have shifted from consumer-facing sectors to those pushing the boundaries of innovation. In particular, the Retail sector has seen its share of the pie fall by almost 20 percentage points. Funding for the Social & Lifestyle sector has also fallen by nine percentage points.

Enabling Technologies — such as AI and semiconductors, which continue to lay the foundations for further innovation to take place — has been the biggest gainer in terms of the share of funding received, increasing by 11 percentage points and capturing 18% of capital invested in 2024 so far this year. The Sustainability / Climate sector is coming in at a close second, representing 17% of total funding.

"Often people say, ‘you must be so good at predicting the future because you had it right so many times’. And then I think, ‘but actually we just embraced that we don't know the future’. We are quick adopter at scale and that's currently still what we're doing. I see Adyen as a large scale up even now with 4,000 people in.

Pieter van der Does

CEO and Founder, Adyen

75%

Examining the progression of startups that raised a Seed round in 2015 reveals notable differences across sectors. Finance and Digital Infrastructure companies outperform the average benchmark for Europe across the funnel while Education, Health, and Social & Lifestyle lag behind.

A significant driver of this disparity is likely Europe's distinct market structure, especially in Education and Health, where startups are often reliant on public sector procurement processes, which can be lengthy and difficult to navigate.

Meanwhile for Finance, there are unique factors at play such as the more unified regulatory framework like the Payment Services Directive 2 (PSD2) or the more fragmented banking system in Europe that traditionally charged higher fees, especially for cross-border transactions.

While sectors are a high-level way of categorising companies, themes relate more specifically to a company’s products or services, or how they might describe themselves — as such, they are not mutually exclusive. For example, within Finance, a number of companies focusing on selling software solutions to finance teams might also provide credit cards for spend management, meaning they fit both the finance teams and payments themes.

We track more than 70 unique themes, from agritech, where more companies are developing sustainable food alternatives, to digital clinics, where an increased focus on prevention is driving innovation in healthcare.

Europe’s biggest success stories of the past decade? Spotify and Revolut.

That’s according to our survey respondents, who were asked to name the company they thought was emblematic of Europe’s growth over the past 10 years. This was an optional question and no prompts were provided — impressively, Spotify and Revolut were named by 26% and 15% of respondents, respectively. But what's more is that more than 110 unique companies were named by respondents more than once, and close to 30 mentioned over 10 times.

Describing these companies as European champions hardly captures their impact. Some of these globally recognised brands have inspired both founders and investors, and are part of the draw for many new joiners coming from outside of tech. Spotify has transformed the music streaming landscape and created a ripple effect in the wider market for digitally distributed audio content.

Finance companies — Revolut, Klarna and Adyen — grab the next top spots, underlining Europe's characterisation as a global centre of excellence for finance. Finally, the presence of Mistral, which was only founded in 2023, in a list of the most influential companies of the past decade highlights Europe's ambitions to create its own AI leaders.

HQ: Sweden

580+ mentions

HQ: United Kingdom

350+ mentions

HQ: Sweden

110+ mentions

HQ: Netherlands

90+ mentions

HQ: France

90+ mentions

HQ: Netherlands

85+ mentions

HQ: Finland

60+ mentions

HQ: Estonia

60+ mentions

HQ: Romania / United States

50+ mentions

HQ: Germany

50+ mentions

HQ: United Kingdom / Estonia

50+ mentions

HQ: United Kingdom

45+ mentions

The region has shown it can build $50bn+ companies time after time. It has the capital to fuel the next generation of founders. It has a deep talent pool, with more people holding equity, laying a strong foundation for future success. And with the AI technological revolution underway, the opportunities ahead are limitless. Whether you are a founder, investor or a policymaker, don’t hold back — Europe’s future depends on it."

Hannah Seal

Partner, Index Ventures

Looking at the themes of rounds under $5M, we can see where momentum is building — and where $B+ companies might emerge.

AI / ML — which ranges from generative AI, AI computing infrastructure and more general AI applications — have long been favoured by investors, but there has been a recent surge in investment activity. So far in 2024, 23% of all sub-$5M rounds have been in this theme, with nearly one in every four VC dollars allocated to this area. Sustainability-related themes — energy, transportation, carbon management and new materials — have also taken numerous spots in the top 20 themes in 2024. On the other hand, the tables have turned for the likes of travel and gaming, which are no longer featured in the list as of 2024.

Comparing today’s most invested themes with those of 2015 provides a window into the journey technology is taking, as it becomes increasingly ubiquitous. Retail and Social & Lifestyle related themes — e-commerce, sales & marketing, communication and social platforms, entertainment, travel, and gaming — captured the lion’s share of investment back in 2015. Today, a greater proportion of capital is being invested in AI / ML, energy or even blockchain, as technology turns to the digitalisation of traditional sectors.

If we look at the evolution of the $B+ distribution across sectors, we can expect the early-stage energy and AI / ML companies of today to become the $B+ companies of tomorrow.

Today, one in every five venture capital dollars goes towards building a more sustainable future, where new technologies and innovations are necessary to turning that vision into reality. This trend has been picking up pace over the past decade and emphasises the effort companies are putting into pursuing that, as well as the sizable opportunity investors are recognising.

Between 2015 and 2021, the share of funding that companies in sustainability themes raised hovered between 9% and 12%. In 2022, this increased to 18%, followed by a high of 27% in 2023, driven by megarounds such as 1KOMMA5°’s $473M Series B round (part equity and options to finance potential acquisitions) and Verkor's $935M Series C. Funding rounds of this magnitude have not been as common in 2024, and capital invested in this theme has come down to pre-2022 levels as a result.

Looking at the biggest movers in Seed stage funding reveals key trends that are likely to pick up momentum in the near term.

Carbon management — which encompasses both active reduction technologies like carbon capture as well as carbon management software — has seen a significant increase in its share of funding, climbing 39 places in our rankings over the past decade. For context, in 2024 over 350 unique companies in the carbon management theme have raised funding compared to less than 100 in 2015. This reflects growing recognition of the urgency and opportunity to address climate change through innovation.

Blockchain has also made a surprise comeback, rising 37 places. More recent positive regulatory developments, such as the SEC’s approval of Bitcoin and Ethereum Spot ETFs, along with the Federal Reserve’s interest rate cut in September, and the recent acquisition of Bridge by Stripe (the largest crypto acquisition by a major payments company), could boost further momentum in this space.

21%

Together with S&P Global Market Intelligence, we have been able to track the evolution of the sustainability conversation, both in terms of volume and topics. By going through the dataset of machine-readable earnings calls from listed technology companies, quarter by quarter, mentions of sustainability topics were extracted and injected into a proprietary LLM model to identify and contextualise trends over time in the US and Europe.

The AI classification model reveals a shift over time from compliance to strategy — in other words, companies are moving from viewing sustainability as a mere compliance requirement to integrating it as a fundamental component of their business strategies, driving overall shareholder value.

In addition, companies are increasingly defining specific sustainability goals linked to brand reputation and consumer expectations, and linking these to measurable results and long-term commitments. Indeed, we are seeing an increase in carbon-related mentions (e.g. carbon emissions, offsetting, and net zero), which underpins the appetite for more solutions in the space. This is likely to be a strong growth driver for the carbon management software solutions theme.

While the shift in the narrative towards measuring impact is positive, the decline in overall mentions could be an early indicator that, in a tougher macro environment, companies are pushing sustainability further down the priority list and focusing their resources elsewhere. If this trend continues, it could have knock-on effects for technology companies building in this area.

A large number of founders are moving into the space, building companies that focus on not just making a profit but also tackling some of the most complex societal and environmental challenges we’re facing. They use new tools and technologies to create inspiring innovation in areas such as the transition to renewable energy, battery technology, and corporate carbon emissions measurement and management."

Terese Hougaard

Partner, Atomico

Exceptional talent is distributed across many themes in Europe — but increasingly, higher volumes of talent have migrated to companies solving hard problems.

Having overtaken sales & marketing, e-commerce and BI / analytics, AI / ML is now the theme that sees the largest number of new joiners, with many transitioning from other parts of the tech industry. Some notable talent magnets include DeepL, Scale AI and Synthesia, as well as Open AI.

Energy and HR tech have entered the top 10 after being absent in 2015. Notably, energy’s rise is characterised by a large influx of new joiners from outside of the tech industry, highlighting the diversity of roles and sector-specific knowledge needed to advance the transition to net zero. Following the large rounds raised in 2023, 1KOMMA5° and Verkor have been adding to their teams. Personio, Deel and Factorial are among the top names for HR tech.

Sectors and themes are the top two layers of our taxonomy, but as the tech ecosystem and our economies continue to evolve, how can we predict the next big ideas on the horizon?

This year, we set out to quantify this by conducting an in-depth analysis of how companies in the European startup ecosystem describe themselves. The aim is to identify the new ideas, technologies and business models around which an increasing number of companies are clustering. A 'cluster' can emerge and diverge within a theme or sector, although we only ever classify individual companies into one cluster.

These clusters are useful indicators of the innovative ideas that Europe's entrepreneurs are putting their energy into. As they mature, they could become investment themes in their own right. They also reflect market opportunities — either by expanding existing ones, with new AI-powered applications for enterprise businesses for example, or by identifying entirely new ones to displace existing solutions, such as nuclear fusion for more sustainable energy sources.

This lens also allows us to break down the dominant AI / ML theme into the sub-trends that are fuelling the theme’s rise. The application of AI across multiple sectors and problems has led to the emergence of several new clusters, from AI-driven finance to real estate. In particular, the application of AI in the enterprise space is gaining momentum, with companies such as Timefold, which helps companies create optimised employee schedules, and Userled, which uses AI to personalise the sales process.

We can also drill into Sustainability / Climate-related clusters, and in particular the energy theme which is attracting a bigger share of capital this year. We see a new renewable energy solutions cluster ranging from German battery storage company Voltfang and Norwegian wind farm project planner Vind.

"Atomico’s latest survey underscores the maturation of Europe’s tech ecosystem, with AI now a crucial driver of investment, talent demand, and opportunity. As we enter the intelligence age, Europe has the chance to lead a new era of AI driven growth. But to achieve this, Europe must act swiftly and boldly—prioritizing competitiveness and policies that help all sectors embrace this technology.

Sandro Gianella

Head of Policy for Europe, OpenAI

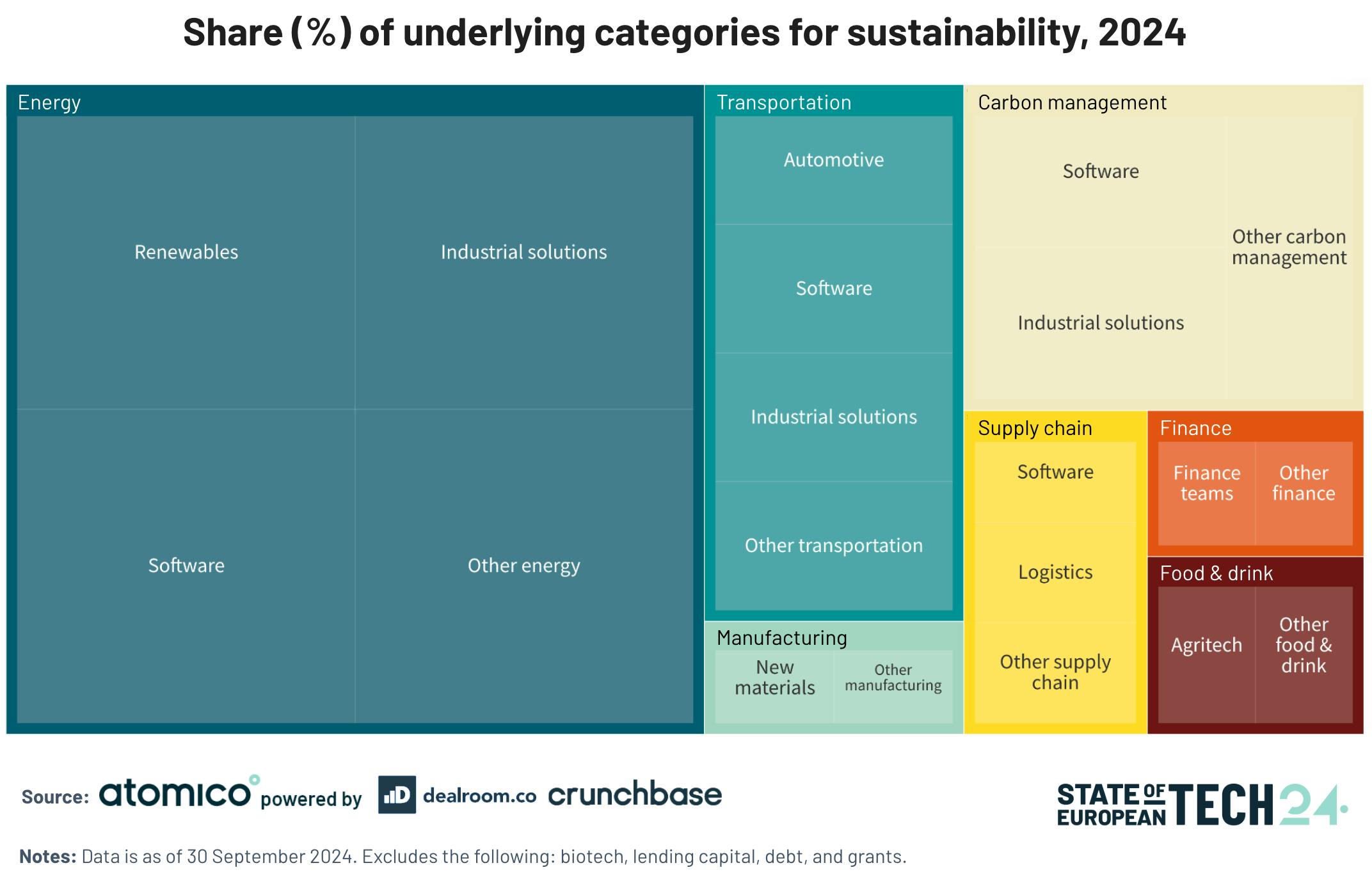

Sustainability is a broad category and funding spans the sector. Energy and the transition to cleaner solutions is the underlying theme that has attracted the most capital over the past decade, as startups develop new types of clean energy infrastructure, from smart software solutions to carbon capture. Cleaner transport solutions and carbon management take the next largest shares.

The spread of investment across sustainability themes over the past decade presents an opportunity and a challenge for those building in the space. On the one hand, it points to the ongoing maturity of the Sustainability / Climate sector, which now cuts across multiple sectors and themes and is constantly seeing new clusters emerge from within. On the other hand, at a time where progress is most urgent, finding the right investor to back large fundraises in a specialist space has only become more difficult.

A shift from fossil fuels to low-carbon electrons, creating unprecedented market fragmentation; radical corporate accountability demanding true sustainability; and technological advances in AI and data science enabling solutions that weren't possible even two years ago. With successful disintermediation in sectors such as Finance, there is an opportunity for new players to completely reshape the energy market."

Joe McDonald

Co-founder & CEO, tem.

Sustainability covers a wide range of business types, from software and asset-light companies to more capital-intensive deep-tech innovators. These companies are building for a more sustainable and efficient world — a world we haven't yet arrived at — and need access to committed, long-term partners.

We looked at who the top funders are in this sector, particularly those who have participated in rounds of more than $15M, where access to growth-stage capital can be a barrier. While there are many generalist venture funds investing in this space, we also found a number of specialist players among the top investors by number of rounds participated. For example, sustainability focused firms Lowercarbon Capital, Energy Impact Partners and Demeter are among the top firms by investment since 2015 in Europe. Government entities are also particularly active in direct investments in Europe, accounting for 18% of top investor activity, compared to just 1% in the US — French government-backed BPI France appears to be the most active sustainability investor in Europe over the period. In the US, corporations and corporate venture funds such as Amazon, Google Ventures and the like are far more active than in Europe.

Most LPs are still inclined towards generalist funds, but there's a clear trend towards increased interest in thematic funds, with deep tech emerging as a primary focus. Fifty-seven percent of LPs surveyed say they are conducting due diligence on deep tech funds, indicating potential future commitments or a growing interest in investing with more specialised fund managers. Sustainability also ranks high, with 42% of LPs interested, while 50% have explored other thematic areas. This trend towards due diligence in deep tech and other themes may well be a leading indicator of greater capital allocation to more specialised fund strategies.

Europe’s deep tech ecosystem boasts a combination of research excellence, a strong talent pool from world-leading institutions, and success stories like Deepmind keeping the flywheel in motion.

Funding has followed accordingly, with investment in deep tech themes increasing from a modest $2.5B in 2015 to a high of $18.9B in 2021. Funding levels have dipped in line with the recent market activity, but remain well above even 2020 levels. So far in 2024, $14B has been invested into deep tech, representing a 85% increase on 2020 levels and an impressive 450% rise compared to a decade ago.

If you think about innovation, Europe clearly showed leadership in areas like fintech, deep tech and sustainability. And now, we can see Europe making big steps in quantum computing, in AI, robotics and biotech, supported by financing from Europe."

Gillian Tans

Former CEO, Booking.com

Since 2015, deep tech companies in the US have raised over $310B, while Asia and Europe are neck and neck around the $100B mark (at $123B and $94B, respectively). The accelerated rise in US deep tech funding figures is largely attributed to its growing AI / ML scene. In the last two years, Enabling Technologies contributed just over half of all deep tech funding in the US. OpenAI's $10B round in 2023 alone accounted for 22% of the total capital raised by deep tech companies in the US that year. But even without these outlier rounds, the US is currently outpacing all other major economies in the world, by nearly four times.

The top two names in deep tech have reached significant milestones this year, with OpenAI hitting more than 1 million paid users and SpaceX's Starship booster successfully completing a first of a kind landing. Meanwhile in Europe, Northvolt, once touted as Europe's electric vehicle battery champion, is now fighting to stay afloat.

Moonshot companies like these require significant amounts of funding as they grow. Across the top 10 best funded, they have collected $60B of venture capital financing. The vast majority — eight out of 10 — are based in the US, a ratio that remains the same when we look at the top 100 companies in terms of capital invested.

With less growth capital available in Europe, local champions face a higher barrier to success from the outset. While the nature of pursuing these ideas means that some will fail, Europe must also work hard to ensure that it doesn't fail them.

Many early-stage companies are turning to smaller loans from local banks, often backed by government guarantees, to mitigate risk. These are frequently combined with larger working capital facilities sourced from global banks, offering more liquidity as companies scale. To further boost cash flow, some firms are relying on R&D tax credits as a critical liquidity source. Hardware-dependent businesses are also adopting sale and leaseback agreements or equipment financing to cover capital-intensive hardware expenditures. Additionally, many companies are shifting from traditional one-off sales models to a hardware-as-a-service approach, allowing them to secure upfront customer payments, which supports ongoing innovation and expansion. This multi-faceted approach to financing reflects a growing sophistication in how European tech companies manage capital needs."

Sonya Iovieno

Head of Venture and Growth Banking, HSBC Innovation Banking UK

From foundation models to first-of-a-kind products, the amount of capital required by some deep tech companies to compete on a global scale can be substantial. The journey to scaling such complex technologies is often non-linear, with companies going through cycles of funding, scaling and cost management before fully optimising their business models or even securing customers.

These are business models that require a large base of investors with not only deep pockets, but a high degree of patience and commitment, too.

While the majority of rounds are backed by VC funds, government agencies fund nearly a quarter of the rounds mapped through direct investment in Europe. This is thanks to the role played by Bpifrance and other very active Pre-Seed and Seed government investors.

This differs from the US, where there is a larger base of VC funds with deep pockets to invest in the space, as well as strategic corporate VCs (such as Google Ventures, Microsoft M12, Intel Capital). Across both Europe and the US, the most active corporate investors are Tencent, NVIDIA and Microsoft.

The continent is home to a number of global AI / ML leaders. France’s Mistral, now valued at over $6B after less than two years in business, is often touted as a frontrunner, but there are plenty more European successes to pay attention to. Hugging Face, Synthesia, Kyutai, Stability AI — the list goes on.

It’s also worth noting the outsized impact OpenAI has had on inflating the US’s overall fundraising figure. Its most recent $6.6B round closed after the cutoff point for our data — meaning the company’s total funding now accounts for 7% of the overall $245B AI funding raised in the US since 2015.

10x

"Choosing to build our technical team in Europe was a forward-thinking decision, and the region's rich tech talent ecosystem has been precisely what we needed to develop next-generation AI for software engineering. The blend of world-class technical expertise, emphasis on sustainable growth, and access to enterprise customers through collaborations with organizations like AWS has been transformative.

Eiso Kant

CTO & Co-Founder, poolside

AI has dominated tech discussions since late 2022, with mentions of the topic in public tech company earnings calls across the US and Europe doubling quarter-on-quarter following the launch of OpenAI’s ChatGPT. This surge peaked in mid-2023, driven largely by the rapid rise of generative AI, which has since overshadowed traditional machine learning and predictive analytics.

For private markets, this shift signals a pivotal trend: as enterprises increasingly prioritise AI-driven solutions, demand for innovation in generative AI could reshape purchasing strategies, potentially intensifying competition from incumbents already adopting AI at scale. This may also be a leading indicator of heightened M&A activity as companies seek to integrate generative AI into their capabilities.

While the US and China dominate AI funding globally, several European nations rank highly when looked at individually.

The UK ranks third on the list of top countries by AI funding, having invested $4B so far in 2024. It holds this position comfortably ahead of Canada, which is in the next top position, having invested more than twice the amount into AI.

Germany and France have also made strong showings, ranking in fifth and sixth place respectively, and each allocating over $1B each to AI companies. These countries demonstrate Europe’s growing influence in the AI race, despite the continent’s broader funding gap with the US.

| Rank | 2024 top countries | 2024 funding raised ($B) | 2015 top countries | 2015 funding raised ($B) |

|---|---|---|---|---|

| 1 | United States | 47.2 | China | 9.4 |

| 2 | China | 10.9 | United States | 7.4 |

| 3 | United Kingdom | 3.8 | United Kingdom | 0.5 |

| 4 | Canada | 1.5 | Israel | 0.4 |

| 5 | Germany | 1.4 | India | 0.4 |

| 6 | France | 1.1 | Canada | 0.3 |

| 7 | Israel | 0.9 | Germany | 0.2 |

| 8 | Singapore | 0.8 | Singapore | 0.2 |

| 9 | South Korea | 0.7 | France | 0.1 |

| 10 | India | 0.6 | Ireland | 0.1 |

Europe has a long way to close the gap with the US in terms of AI funding. In 2024, the US will have invested $47B in AI, compared to Europe's nearly $11B.

However, it's not too late for Europe to catch up, and the continent has made remarkable progress over the past decade. In 2015, AI investment in Europe was just over $1B, meaning that it has seen an almost ninefold increase in funding over the past decade. This momentum is far greater than that of the US, and has put Europe on a par with China, the former leader in AI funding.

The ambition to build global AI leaders in Europe is there, with examples all around. The UK's Wayve is going head-to-head with the US's Waymo in the self-driving arena. AI mafias are also emerging — H Company in France was founded by ex-DeepMinders and recently raised one of the country's largest Seed rounds. Black Forest Labs was founded by Stable Diffusion alumni and is now competing with Midjourney in text-to-image generation. Meanwhile, Poolside, founded by the former CTO of GitHub, is building the next generation AI for software engineering, Germany’s DeepL is setting new standards in translation tech, and France’s PhotoRoom continues to break ground in image-editing AI.

The opportunity for AI breakthroughs in Europe is immense, but more funding will be key to unlocking these ambitions on a global scale.

To make this a reality, we must invest in and retain innovation here, fuelling a sustainable cycle of growth and creativity that benefits our economies and future generations alike. Europe has the talent pool, the innovation spirit and a market big enough to compete, but capital is lacking to enable that mission."

Alexandru Marin

Founder & CEO, INFINIT

Talent is the driving force behind any startup and has been transformed over the past decade. In this chapter, we dig into who the individuals forming the beating heart of Europe’s tech ecosystem are — from founders to employees — and unpack what's changed and how they feel about the future.

Hard data on the European tech ecosystem forms the backbone of The State of European Tech, but just as important are the annual survey results we obtain from our readers — the people working in the tech community and driving Europe forward. This fast-track insight highlights the insights that can only be gathered by speaking to those who live and breathe the ecosystem.

The pace of AI-driven innovation is only accelerating, and in 2024 Europe has continued to bolster its position as a global leader in this theme, although there is still room to grow. This fast-track insight tells the story of how AI came to be the theme on everyone’s mind in Europe and beyond over the past decade.